Financial Transitions Planning

Life is a journey marked by meaningful milestones, each bringing new challenges and opportunities that can shape your financial future. As a Certified Financial Transitionist™, I am dedicated to providing the guidance you need through life's pivotal moments-whether it's marriage, divorce, career changes, retirement, or the loss of a loved one. With a unique focus on both financial stability and emotional resilience, we'll work together to help you approach these changes with clarity and confidence, empowering you to embrace each transition with peace of mind.

Life Transition Events (LTEs) and Sudden Money Events (SMEs)

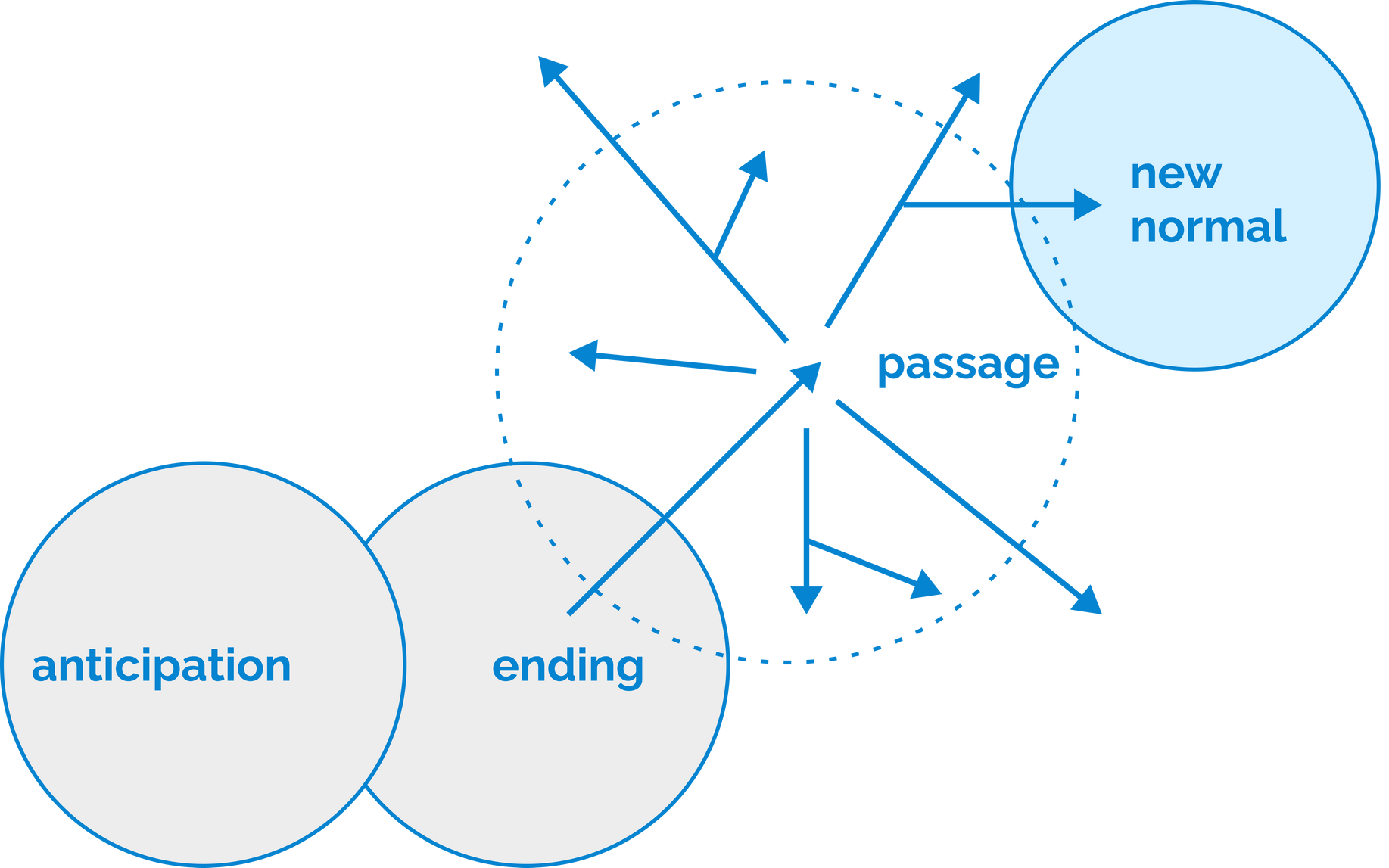

Life is filled with change. Major Life Transition Events (LTEs) like marriage, career shifts, or family loss can alter our paths indefinitely.

While these transitions are temporary shifts we go through, they can lead to further changes. Your ability to navigate these shifts can impact your future financial and emotional well-being. Sudden Money Events (SMEs) due to events like death, divorce, or retirement can be tough to handle, especially if they involve large sums of money.

I'm here to help guide you in the grey area of your passage from "what was" to "what will be".

Change Management

Change management isn’t taught in school, yet it’s crucial when facing financial windfalls or downturns. Both sudden gains and losses come with unique challenges.

While we can’t control life’s events, we can control our responses. The impact of a Sudden Money Event (SME)—whether planned or unexpected—depends on your ability to embrace uncertainty and transition thoughtfully. Change, when approached with patience and reflection, can offer valuable insights into your sense of self and purpose.

I offer a disciplined approach to managing the emotional and personal aspects of sudden financial changes. By integrating the technical and human sides of finance, I aim to help you avoid costly mistakes and navigate transitions smoothly.

How I Can Help You

Get Personalized Planning

We blend your personal goals, beliefs, and dreams with your new financial reality.

Avoid Costly Mistakes

Our disciplined approach helps prevent hasty decisions driven by stress and emotions.

Get Holistic Support

We address both the technical and human sides of finance, ensuring comprehensive support during transitions.

Reach out to us today

Helping Clients Make Smart Financial Decisions During Life’s Transitions.

Sign up to our newsletter

We will get back to you as soon as possible

Please try again later

(860) 647-7795

jjohnson@jan2invest.biz

945 Main St, Suite 306

Manchester, CT 06040

Privacy Policy | Terms of Use

Check the background of your financial professional on FINRA's BrokerCheck.

Licensed To Conduct Business In The Following States: Arizona, California, Connecticut, Florida, Iowa, Massachusetts, Nebraska, New Jersey, New York, North Dakota, Pennsylvania, Rhode Island, South Dakota, Virginia

Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC, Advisory Services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Jan Johnson Financial Planning are not affiliated.